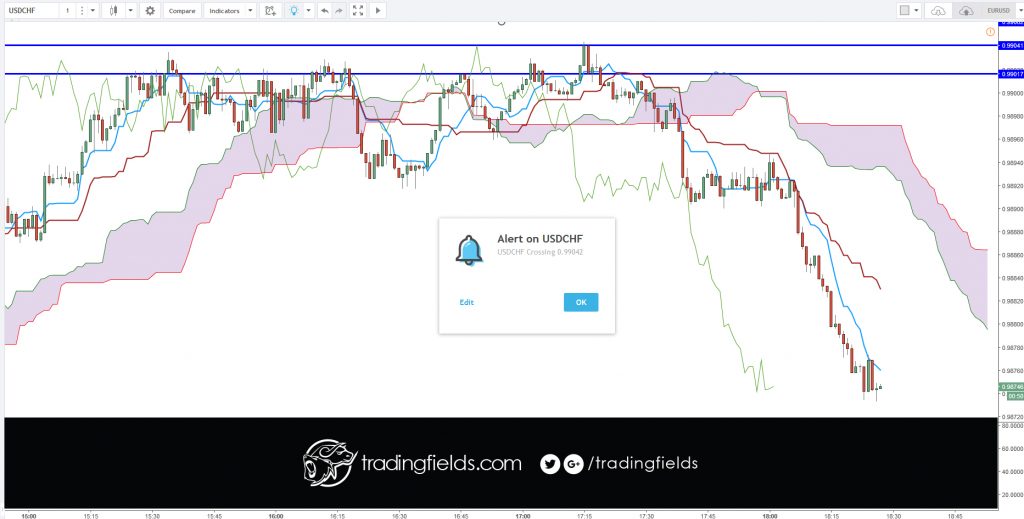

3 areas of resistance were drafted.

Price immediately dropped. I did have the opportunity to close for profit, at this point.

I let the trade run through to breakeven.

Needing to leave my desk, my stop was at the 2nd resistance 0.99041. I felt there was good risk/reward value.

Trade hit my stop and nose dive thereafter.

I am not disappointed though, just look at this chart below. My call was correct.